- Home

- IPR NR Note

- Tech

- Wafer Works (6182 TT): The Growth Trilogy: Wafer Price Hikes, Semi CAPEX & China 12” Fabs

Wafer Works (6182 TT): The Growth Trilogy: Wafer Price Hikes, Semi CAPEX & China 12” Fabs

2021-12-23

Tech

WAFER WORKS (6182 TT): The Growth Trilogy: Price Hikes, Semi CAPEX & China 12” Fabs

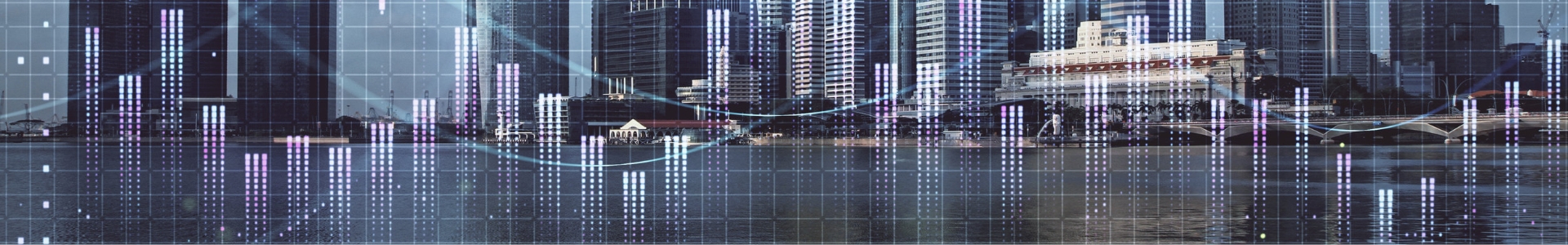

- Silicon wafer is the upstream of semiconductor manufacturing where the rebalancing-of-power between two distinct business models are taking place: 1) Independent Design Manufacturers (or IDM, such as Intel); and 2) Foundry Service Providers (or Foundry, such as TSMC). Examining the entire semi supply chain, we find silicon wafer to be the most consolidated sub-sector with high certainty in competitive landscape, also to enjoy the early harvest of the new wave of Semi Upcycle driven by the aforementioned structural changes.

- Wafer Works captures 1/3 of heavily-doped 8" silicon wafer market share globally where consumption by power semi is experiencing a sharp growth trajectory, thanks to revolution of automobile industry: Electric Vehicle. The announced price hikes and margins improvement year-to-date are the solid proof.

- Looking into 2022, assuming a continuous improvement in pandemic situation worldwide, on-schedule semi capex should lead to rising demand of silicon wafer. The earnings upside potential for Wafer Works is largely depend on the progress of 12" capacity expansion.

- Wafer Works continues to execute its mid-term goal of becoming the silicon wafer market leader in the Greater China region.

- ESG is an important performance indicator within the semi supply chain and Wafer Works is regarded as the long-term trust-based partner by its customers.