- Home

- IPR NR Note

- Non-Tech

- GFC (4506 TT): Triple Profit Lifting Drivers

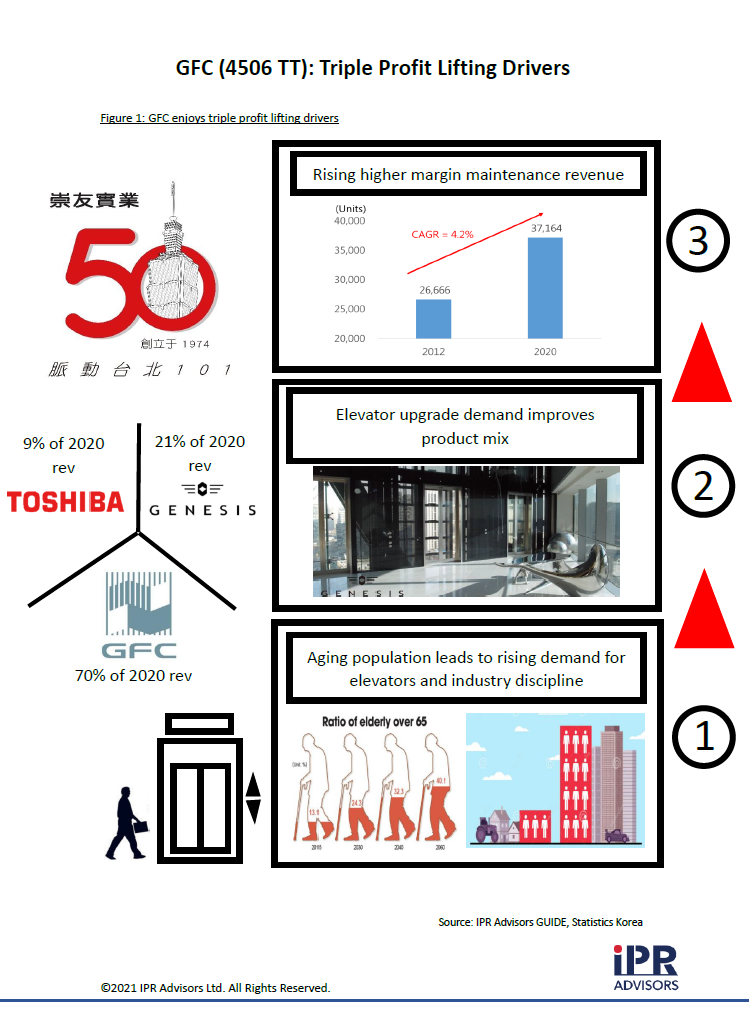

GFC (4506 TT): Triple Profit Lifting Drivers

2021-11-23

Non-Tech

GFC (4506 TT): Triple Profit Lifting Drivers

- Elevator industry is oligopolistic in nature. GFC is Top 3 elevator company in Taiwan in terms of market share. Its brand portfolio consists of two own-brands: Genesis (high-price-range) and GFC (mid-price-range) and one agency brand Toshiba (landmark project: Taipei 101).

- GFC is set to benefit from aging population, industry discipline (Hitachi recently acquired the-once-price-destroyer YungTay), better product mix (driven by Genesis and innovation) and steady growth of high-margin maintenance revenue.

- During an elevator lifespan of > 15 years, regular maintenance is mandatory in Taiwan for safety reasons. Maintenance revenue enjoys high gross margin, provides strong cash inflow and helps GFC to sustain ROE of over 15%.

- With solid order backlog, GFC's strong balance sheet, positive free cash flow and high dividend payout make it an ideal low-beta and high-yield stock.

- GFC embraces facial recognition technology powered by "FaceMe" of Cyberlink (5203 TT). With clear ESG milestones to achieve, GFC will celebrate its 50th anniversary in 2024.